Zet de stap naar méér rendement op de beurs.

Wilt u wel het rendement, maar niet het gedoe van handelen in opties of aandelen? Beleg dan met slimme software. Ontdek onze trading systemen.

- Nummer 1 van Nederland - 50 trading systemen - Team 50+ jaar ervaring

4.5 / 5

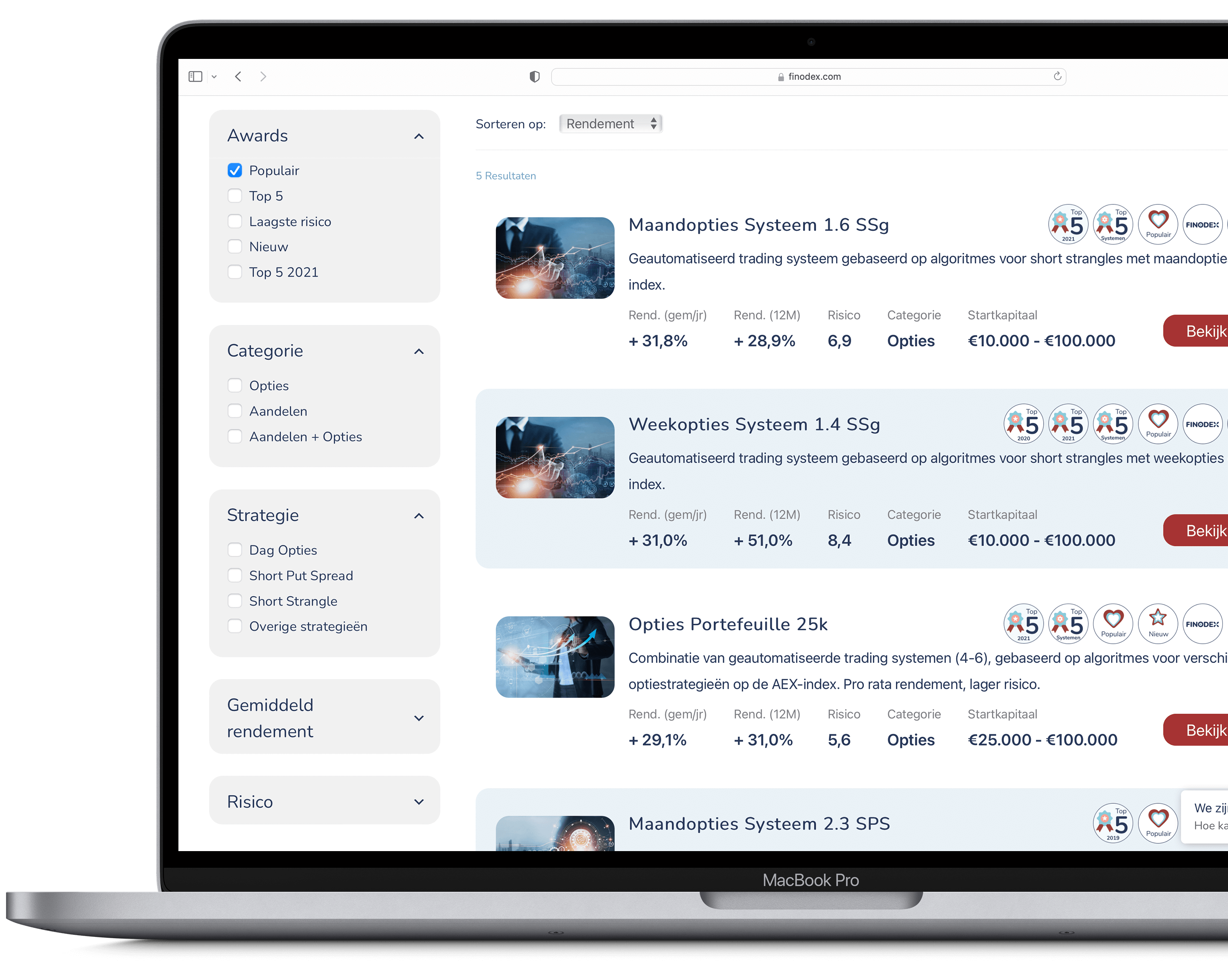

Vergelijk de rendementen

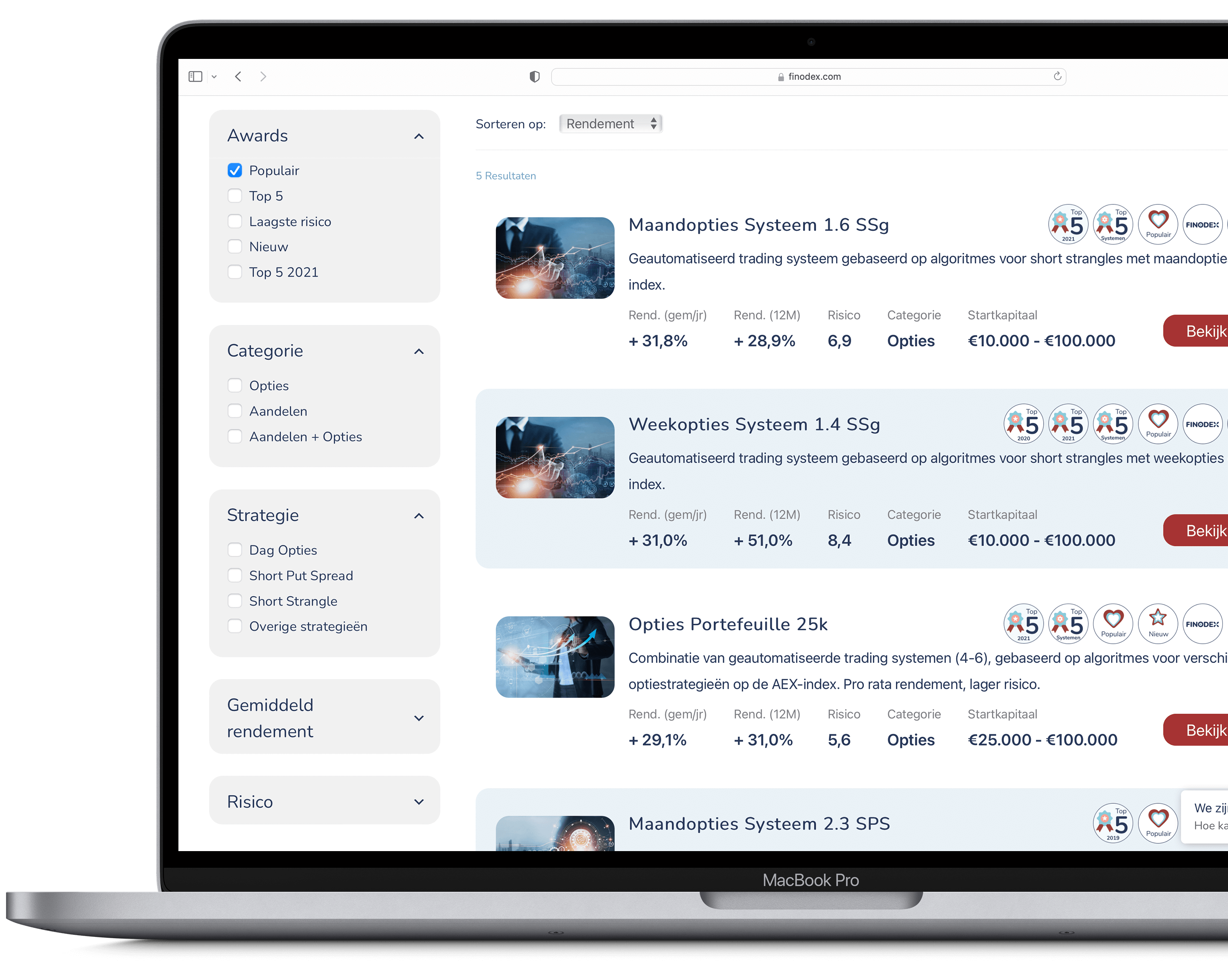

Dit zijn onze 5 populairste trading systemen.

1. FTS US Stocks and Options

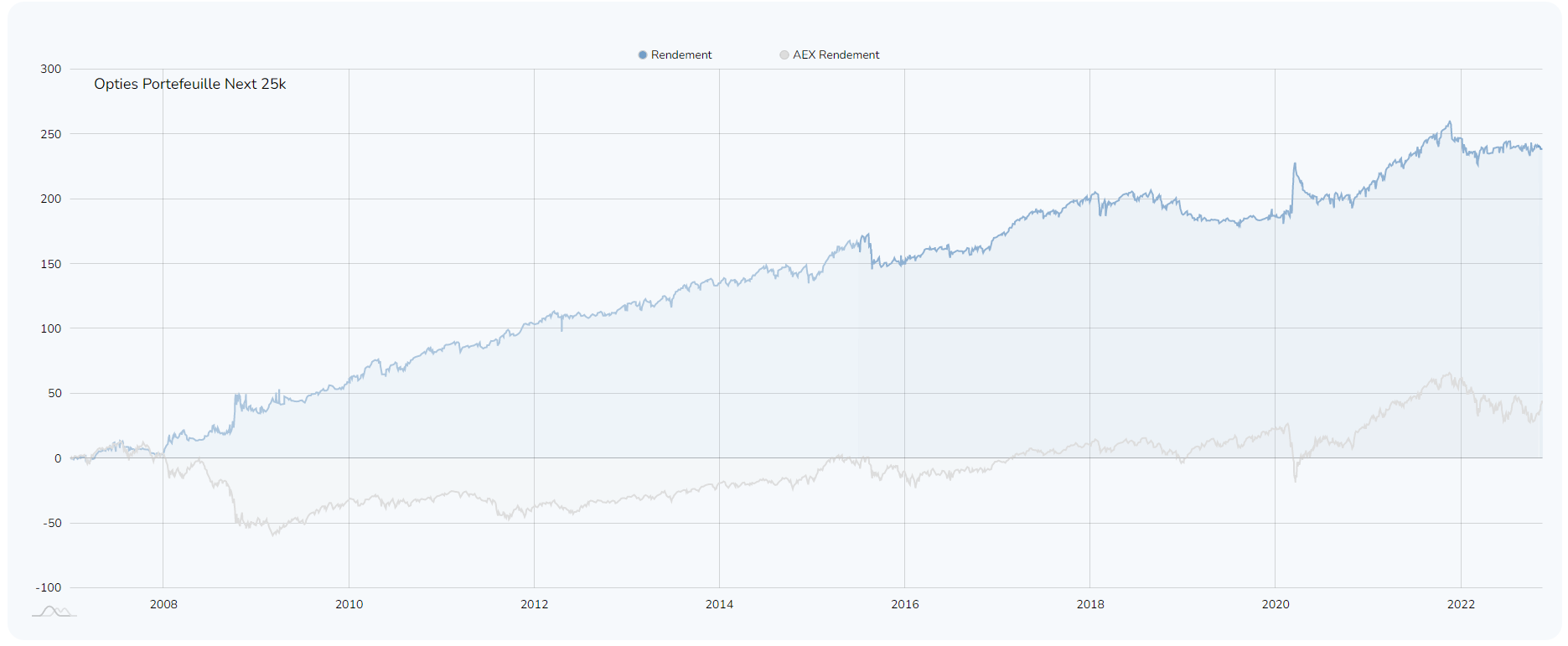

2. FTS Options Income NL Next

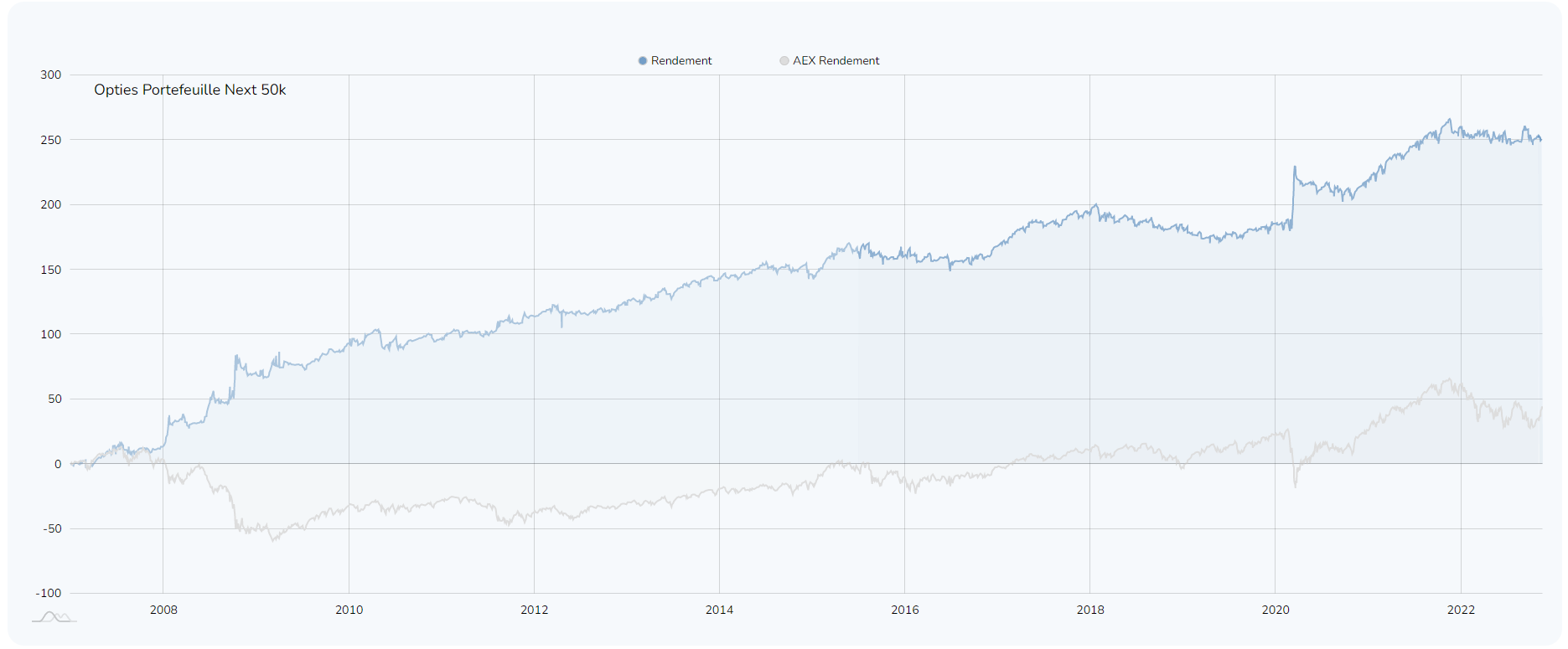

3. Opties Portefeuille Next 50k

4. FTS Options Income NL

Is een trading systeem iets voor mij?

Professionele beleggers doen al jaren niet anders.

Heeft u een beleggingsrekening bij een bank of broker? Dan kunt u direct starten.

Heeft u een rekening bij een broker die is aangesloten op ons platform? Dan kunt u ook gebruiken maken van Copy Trade.

Dit is hoe slimme software

voor u belegt

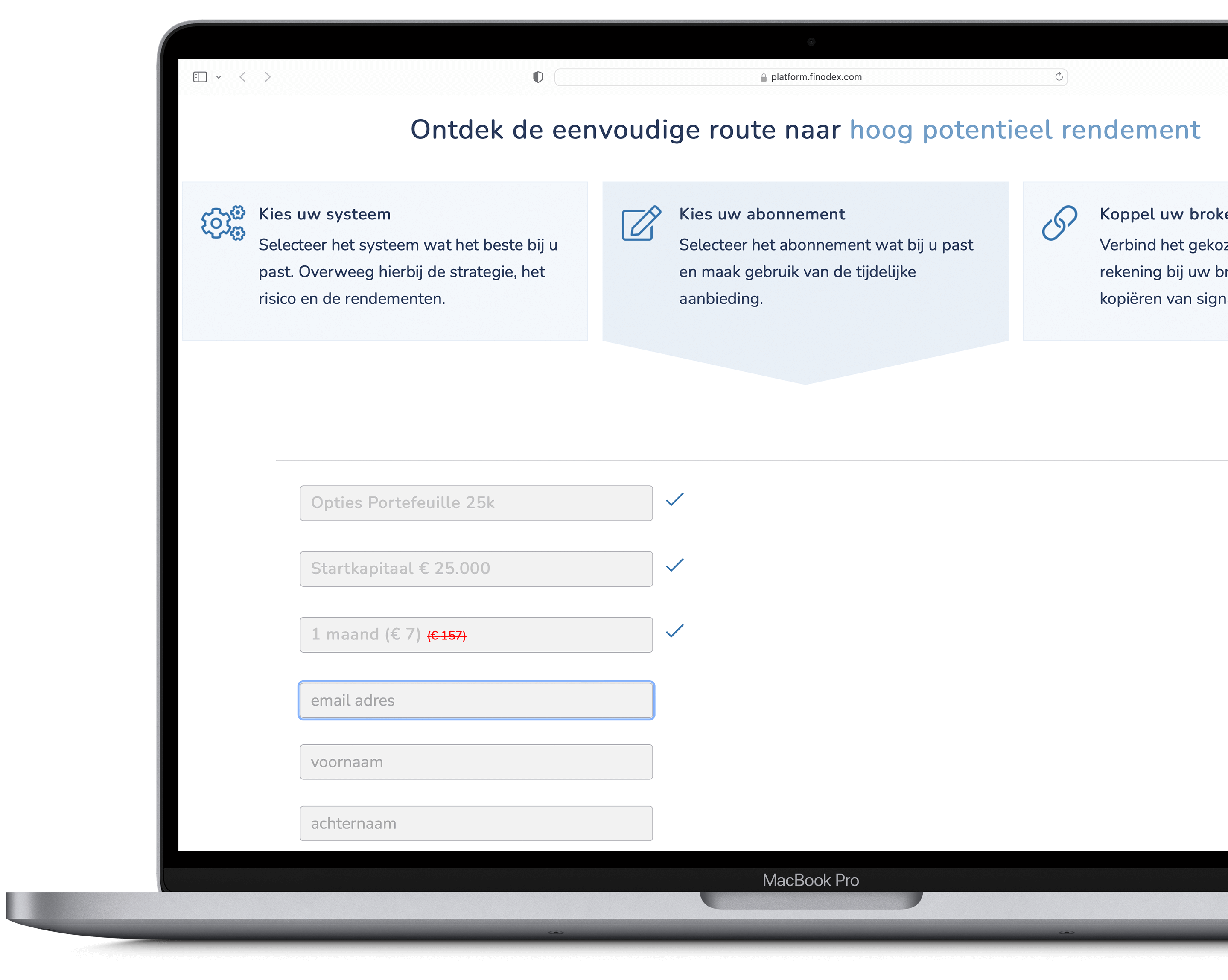

U kiest een systeem

Bij Finodex beschikken we over meer dan 50 trading systemen. Opties, aandelen of combinaties van aandelen en opties. U kiest het systeem dat het beste bij u past.

U meldt zich aan

Voor het gekozen systeem sluit u een abonnement af. U bepaalt voor hoe lang. Wilt u niet meteen ergens aan vast zitten? Probeer dan eerst ons kennismakingsabonnement.

De transacties kunt u eenvoudig via uw eigen bank of broker uitvoeren.

U volgt de signalen

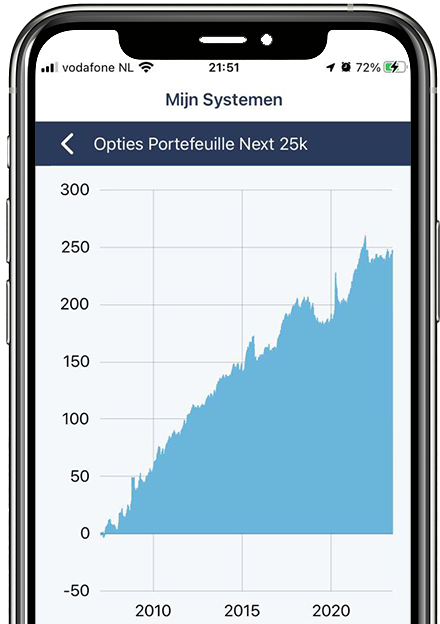

Het systeem stelt transacties voor. U ontvangt hier meldingen van via de Finodex app. Zodra u een transactie goedkeurt, kunt u deze eenvoudig via uw eigen bank of broker uitvoeren. Is uw broker aangesloten op het Finodex platform dan kunt u een transactie met één klik goedkeuren en uitvoeren via uw broker.

Heeft u vragen? U kunt altijd bij ons team terecht.

U bent 100% in control

Een trading systeem handelt automatisch. Dat gaat echter nooit zonder uw toestemming. U kunt iedere transactie zelf goedkeuren of afwijzen.

Onze klanten en hun succesverhalen

Ontdek hoe anderen deze manier van beleggen ervaren.

5 / 5

Aanrader

Joop

Ik vertegenwoordig zo'n 60 jaren beleggerservaring. Deed het altijd zelf, maar heb nu, na slechte ervaringen met enkele cowboy-vermogens-beheerders in het land, dik een halfjaar ervaring met Finodex. Ben bij hen klein begonnen, heb na 4 maanden besloten tot een upgrade naar het systeem Opties Portefeuille ...K en sta nu op het punt een 2e systeem toe te voegen aan mijn account. Dat illustreert mijn vertrouwen in Finodex. Ik heb hen leren kennen als een veelzijdige, effectieve en uiterst transparante partij, die bewijsbaar rendementen levert die er toe doen. En altijd bereikbaar. Beveel ik Finodex aan? Ja, met overtuiging! Lees verder

4.5 / 5

Professioneel, mooi en overzichtelijk systeem

Peter

Professioneel, mooi en overzichtelijk systeem. Signaalbevestiging is gebruiksvriendelijk. Notificaties worden zelfs op Iwatch ontvangen waardoor accuraat gereageerd kan worden. Prima platform.

4.5 / 5

.......de koersen van vandaag en morgen doen er niet toe bij deze trading systemen moet je ook een "beleggingshorizon" hebben...

Karst

.......de koersen van vandaag en morgen doen er niet toe bij deze trading systemen moet je ook een "beleggingshorizon" hebben...

Wij zijn er voor iedere belegger

Of u nu al jaren belegt of pas net begint. Wij zijn er voor iedereen.

Starten kan al vanaf €12.500. Belegt u met meer dan €100.000, dan wijzen wij u graag op de mogelijkheden van ons beleggingsfonds.

De brokers die aan ons platform zijn gekoppeld, vallen onder toezicht van de relevante autoriteiten. Zoals Autoriteit Financiële Markten (AFM), De Nederlandsche Bank (DNB), Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) en Cyprus Securities and Exchange Commission (CySEC)

Kennismakingsaanbod

Eerste maand voor €7 €87. Stopt vanzelf.

Meld u aan voor onze nieuwsbrief en ontvang direct deze korting.